Private Equity

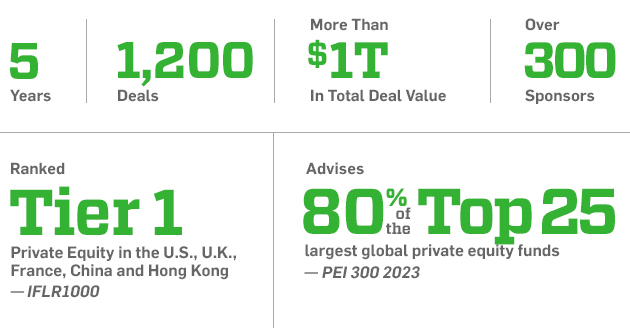

Weil's global Private Equity practice is recognized by the industry as being one of only a very small number of elite, market leaders in this field. Our clients include many of the highest profile private equity funds, sovereign wealth funds and pension funds, as well as family offices and other equity financial investors. Weil advises more than 300 private equity clients worldwide, including 9 of the 10 largest global private equity funds and 80% of the top 25 largest global private equity funds as ranked by PEI 300 2023.

Notable Representations, Key Contacts

Our clients benefit from our:

Global Platform and Deep Bench of Private Equity Lawyers

With approximately 300 lawyers worldwide, Weil has a strong and deep bench of lawyers dedicated exclusively to private equity. Having been steeped in the industry from the start, clients benefit from our 30+ years of sophisticated market knowledge and our ability to provide insight that goes beyond just transactional advice. Across the United States, Europe and Asia, our lawyers work together to provide a seamless service to market leading players of all sizes and across all of the major private equity asset classes and industry sectors. Our Private Equity practice is consistently top-ranked both globally and in each of the regions in which we operate by Chambers & Partners, Legal 500 and IFLR1000, among others.

Experience Across All Major Private Equity Asset Classes

We can advise our private equity clients on the full spectrum of investment products. Learn more about our capabilities by clicking through below:

Seamless and Integrated Services

We provide our private equity clients with market leading expertise and knowledge across a range of disciplines including the ability to:

- Execute across all financing structures in coordination with our private equity finance team

- Help clients raise funds in time critical situations and efficiently through our fund formation team

- Provide clients tax and executive compensation and employee benefits advice

- Provide a full service to our clients encompassing restructuring, governance, antitrust, employment, litigation, and intellectual property.

Client Partnership Philosophy

We work in partnership with our clients to offer a range of value-added services including bespoke training and market trend comparisons. More importantly we develop products and services designed to support our clients at different points in the life cycle of their portfolio companies.

By The Numbers

Key Contacts

See list of lawyers globally

Shortcut Links

Weil advises 9 of the 10 largest global private equity funds and 80% of the top 25 largest global private equity funds

PEI 300 2023

Named Private Equity “Practice Group of the Year”

Law360 2022, 2021, 2019, 2017, 2016, 2014 & 2012

Ranked Tier 1 for Private Equity in the U.S., U.K., France, China and Hong Kong

IFLR1000 2022

Winner of “Private Equity Deal of the Year” for CBPO Holdings Limited’s $4.76B Take-Private of China Biologic Products Holdings

IFLR Asia-Pacific Awards 2022

Shortlisted for “Private Equity Law Firm of the Year”

ALB China Law Awards 2022

Named “SPAC Legal Advisory Firm of the Year”

Mergermarket North America M&A Awards 2021

Winner of “Deal of the Year” for both CBPO Holdings Limited’s $4.76B Take-Private of China Biologic Products Holdings and MBK Partners’ $2.2B Take-Private of CAR Inc.

China Business Law Journal 2021

Band 1 for Private Equity: Buyouts: High-End Capability in the U.K.

Chambers UK 2022

Band 1 for Private Equity in France

Chambers Europe 2022

Tier 1 for Private Equity in Hong Kong for 10th Consecutive Year

Legal 500 Asia Pacific 2022

Named a “Leading” Firm for Private Equity in the U.S. and Asia-Pacific

Chambers Global 2022

Named a “Leading” Firm for Private Equity, Europe-wide and in Germany

Chambers Europe 2022

Named a “Leading” Firm for Private Equity in Germany

IFLR1000 2022

Marco Compagnoni Named to the FN50 Most Influential in Private Equity List

Financial News 2022 and 2020

Awards and Recognition, Speaking Engagements, Latest Thinking, Firm News & Announcements

Awards and Recognition

- Weil Named Private Equity “Practice Group of the Year” Award Brief — Law360 2022, 2021, 2019, 2017, 2016, 2014 & 2012

- Winner of “Private Equity Deal of the Year” for CBPO Holdings Limited’s $4.76B Take-Private of China Biologic Products Holdings Award Brief — IFLR Asia-Pacific Awards 2022

- Weil Named “SPAC Legal Advisory Firm of the Year” Award Brief — Mergermarket North America M&A Awards 2021

- Weil Ranked Band 1 for Private Equity: Buyouts: High-End Capability in the U.K. Award Brief — Chambers UK 2022

- Weil Ranked Tier 1 for Private Equity in the U.S., U.K., France, China and Hong Kong Award Brief — IFLR1000 2022

- Weil Ranked Band 1 for Private Equity: Buyouts in Massachusetts Award Brief — Chambers USA 2023

- Weil Ranked Tier 1 for Private Equity in Hong Kong for 10th Consecutive Year Award Brief — Legal 500 Asia Pacific 2022

- Weil Ranked Band 1 for Private Equity in France Award Brief — Chambers Europe 2022

- Weil Named a “Leading” Firm for Private Equity: Buyouts: High-end Capability, Nationwide Award Brief — Chambers USA 2023

- Weil Named “Private Equity Team of the Year” Award Brief — Legal Business Awards 2020

- Weil Named a “Leading” Firm for Private Equity: Buyouts Award Brief — Legal 500 US 2023

Speaking Engagements

-

Institute for Energy Law’s 2nd Conference on Renewable Project Development

Speaker(s):

Omar Samji

April 27, 2023 — Weil Private Equity partner Omar Samji spoke on a panel titled “Emerging Legal and Commercial Issues across Lower Carbon Hydrogen Value Chains” as part of the Institute for Energy Law’s 2nd Conference on Renewable Project Development.

Latest Thinking

- Weil Private Equity Sponsor Sync - Spring Issue Publication — By Christopher R. Machera, Andrew J. Colao, Jacqueline Oveissi, Arnie Fridhandler, Brittany Butwin, David Griffiths, Alex Paul Cohen, David E. Wohl, Carson Parks, Nicolas Lee, Trey Muldrow, Langdon Neal, Timothy F. Burns, David B. Gail, John P. Barry, Robert Rizzo, Larissa Lucas, Yehudah L. Buchweitz and Zoe Buzinkai — PDF — Spring 2024

- 2023 Pipe Survey Publication — By Ashley Butler, Heather L. Emmel, Arnie Fridhandler, Adé Heyliger, Christopher R. Machera, Jenna McBain, Jakub Wronski, Brittany Butwin, Douglas P. Warner, Jeffrey Fu, Dylan J. Hans, Niko A. Lane, Rob Meyer, James M. Pierre-Louis, Melinda Root and Gracy Wang — PDF — March 21, 2024

- 2023 Going Private Study Alert — By Christopher R. Machera, Craig W. Adas, Robert Rizzo, James R. Griffin, Sachin Kohli, Brittany Butwin, Douglas P. Warner, Courtney S. Marcus, Evert J. Christensen, Benton Lewis, Dorothy Coco, Parker D. Collins, Matthew S. Connors, Geoff Greenspoon, Jason Klig, Jace Krakovitz, Robert Sevalrud, Frank Tsui, Honghu Wang and Leah Whitworth — PDF — January 29, 2024

- After Watershed Year, Clean Hydrogen Faces New Challenges Publication — Law360 — By Omar Samji, Irina Tsveklova and Humzah Qamar Yazdani — January 19, 2024

- Proposed Guidance on Investment Tax Credits for Clean Hydrogen Production Facilities Alert — By Jonathan J. Macke, Omar Samji, Irina Tsveklova, Andrew Lawson and Humzah Qamar Yazdani — PDF — January 18, 2024

- Weil Private Equity Sponsor Sync Publication — By Christopher R. Machera, Arnie Fridhandler, David B. Gail, Olivia J. Greer, Megan A. Granger, Adam C. Hemlock, Katya Dajani and Glenn D. West — PDF — January 2024

- Mapping the Regulatory Landscape for CCUS in Texas Publication — The Texas Lawbook — By Chris Bennett, Omar Samji and Sarah George — PDF — October 11, 2023

Firm News & Announcements

- Weil Advises PAI Partners on its Acquisition of Audiotonix Deal Brief — April 23, 2024

- Weil Shortlisted for Private Equity Law Firm of the Year and Top Deal and Individual Awards at 2024 Thomson Reuters ALB China Law Awards Firm Announcement — April 23, 2024

- Weil Advises Goldman Sachs on Sale of Marcus Invest’s Digital Investing Accounts to Betterment Deal Brief — April 22, 2024

- Weil Advises General Atlantic’s BeyondNetZero Fund on Investment in GRESB Deal Brief — April 19, 2024

- Weil Continues Growth in Houston with Return of Jacqui Bogucki Press Release — April 15, 2024

- Weil Advises NRDC on Its Acquisition of Galeria Deal Brief — April 10, 2024